I thought GE’s 4Q14 earnings would be a good time to revisit the thinking behind this?investment idea. IOI Tear Sheets are one-page investment overviews–this one on GE was published last year–that summarize IOI’s valuation and option strategy. Please also see the GE company analysis page on the IOI Tools site. (New readers might also download the IOI Tear Sheet User’s Guide.)

GE reported that revenues rose 4% in the fourth quarter and 2% for the year overall. This overall growth came despite rapidly falling oil prices (which affect GE’s Oil & Gas segment as well as its GE Capital segment), and the continuing headwind of disposition of GE Capital’s consumer-facing businesses. As a reminder, IOI’s worst case estimate for average revenue growth at GE over the next five years is 1% and our best case estimate is 5%.

Profit margins were also good, though I will have to wait for the 10-K annual report to be published to tell how good according to my preferred measure of profitability, Owners Cash Profits (discussed in The Framework Investing).

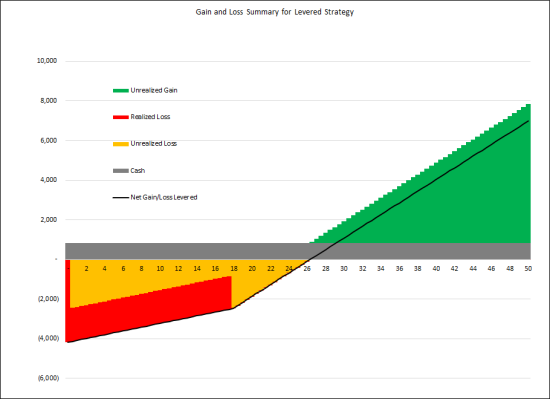

My investment itself has not been doing terribly well considering the market drag due to fears about Europe and oil prices, but nothing in this announcement causes me cause for concern. Just the contrary, actually. From what I see here, my valuation assumptions look reasonable and achievable by the company.