With Crude Oil futures trading below $50 / barrel (bbl), my attention has turned to the effects of low oil prices on General Electric?s business, and on how much an extended period of low oil prices is likely to affect IOI?s valuation of the stock.[1]

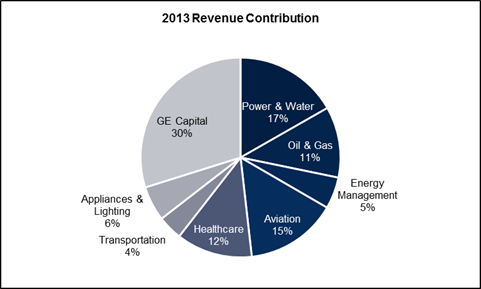

At the close of FY2013, 11% of General Electric?s revenues were directly derived from its Oil & Gas division (as shown in Figure 1 below), but it also has exposure to energy prices through its financing division, GE Capital Corporation (GECC).

This article will investigate the impact of lower oil prices directly on the Oil & Gas division and my next will do the same for the Oil and Gas facing portion of GECC.

Oil & Gas Division?[2]

Growth to Date

This division has been the fastest-growing among GE?s industrial segments. Its growth has been one of the main factors offsetting revenue declines from its divestment of consumer-facing businesses (including consumer finance and NBC Universal) and has been a standout among GE?s otherwise unexciting industrials segments.

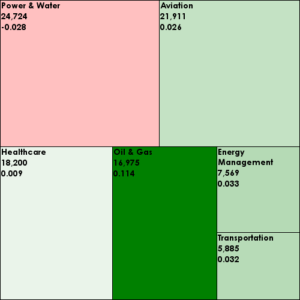

Five-year compound annual growth rates (CAGR) for GE?s Oil & Gas business were just over 11% for the last full fiscal year. At the end of 3Q14, trailing twelve-month (TTM) growth rates were above 17%, meaning that the 5-year CAGR ending in 2014 will be even stronger. (See figure 2 below).

Low oil prices effect service and equipment companies like GE because high-cost mining projects no longer retain economically viability below some break-even price. Temporary oil price falls do not usually make a material impact on demand, but extended periods of low prices do, as customers choose to cancel or indefinitely put off expansion plans for uneconomic projects (i.e., a company would not invest $60 / bbl to develop a new well when oil is trading at $46 / bbl).

Degree of Exposure

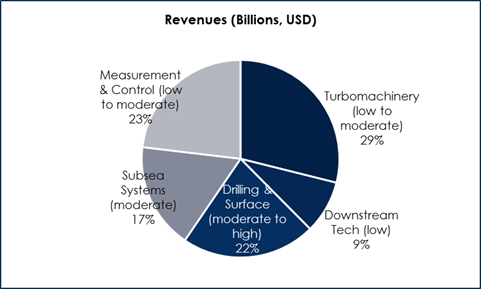

The real question is how much of GE?s Oil & Gas division?s portfolio is exposed to this demand dynamic. Looking at GE?s O&G division, we see it is comprised of five sub-businesses, Turbomachinery, Downstream Technology, Drilling & Surface, Subsea Systems, Measurement & Control. A pie chart of each of these business?s FY2013 revenues is shown in figure 3.

Figure 3. Source: Company Statements, IOI Analysis. Percentage figure represents business revenues as a percent of Oil & Gas, parenthetical is our assumption of the effect of low oil prices on the business

Drilling & Surface deals with products and services for shale fracking customers. Fracking is a fairly high-cost mining method, so we assume this business will face the greatest demand destruction in the face of low oil prices. Subsea Systems?dealing with offshore drilling projects?is also a high-cost mining method. However, because it is so capital-intensive, large projects (such as the deep sea project off the coast of Brazil) operate on longer term contracts, suggesting that impact on this business will not be as severe as long as low oil prices do not last over a multi-year period.

Future Impact [3]

Roughly two-fifths of GE?s $17 billion (FY2013, likely around $20 billion in FY2014) revenue run-rate O&G business seems moderately to very exposed to an extended period of low oil prices.

Let?s assume that demand destruction is very bad and leads to 20% compound annual revenue declines in the exposed businesses and perfectly flat revenues for the other three-fifths of O&G. This scenario would generate roughly 1 percentage point worth of drag to GE?s business overall. A complete vaporization?100% failure?of this portion of GE?s O&G business would generate a roughly 5 percentage point drag on GE?s revenues overall.

Thinking about best- and worst case scenarios for revenue growth of the O&G business, the following seem fairly reasonable:

- Best: +1% growth over the next five years (2015 is tough, but a rebound follows soon after)

- Worst: -3% declines over the next five years (2015-2016 is tough, but a rebound follows)

Clearly, if the 11% of GE?s revenues the O&G segment represents were to decline at a rate of 3% per year, cash flows would face a slight headwind, all other factors held equal. Even if the best-case scenario plays out, the impact on the firm will be negative in comparison to the growth provided by O&G in the recent past, again all other factors held equal.

That said, all other factors cannot necessarily be held equal. Economic recovery in the U.S. seems to be on a firmer footing, and despite GE?s overseas exposure, the firm prospers when the U.S. economy does. For example, lower oil prices means lower prices for aviation fuel, so GE?s aircraft engine business stands to benefit and the aircraft business represents a slightly higher proportion of revenues than Oil & Gas (refer to figure 1).

Note that this discussion has been focused on the first driver of valuation?revenues. Profits will also likely be hurt as the company will likely also offer discounts to spur demand. GE is a relative newcomer to the field, and it may use a period of industry weakness to cut prices in an attempt to steal market share from companies like Slumberger SLB and Halliburton HAL. It is impossible to make projections about profitability or future competitive dynamics at the present time.

Conclusion

Low oil prices are a negative for GE?s Oil & Gas business, but the extent to which this is so is difficult to know for certain at this point. The accuracy of the forecasts depend on how accurate our characterization of the exposure of GE?s various O&G businesses is and also on how long oil prices remain low.

To the extent that O&G is negatively affected by low oil prices, GE?s overall results will face a headwind as well. The true impact will be an interplay between the net benefits to other of GE?s businesses brought about by lower oil prices versus the net negatives to O&G.

At present, there is not enough information to inform our opinion of the valuation impacts of low oil prices on GE through the O&G division. We will delve into impacts through GECC in our next article.

NOTES:

[1] Billionaire investor and Saudi prince Al-Waleed bin Talal opined publically that oil was ?never? going back to $100 / bbl. These comments echo those of Saudi oil minister Ali al-Naimi, made in late December.

[2] GE?s entrance into the Oil & Gas business came in 1994 with the acquisition of Nuovo Pignone, an Italian manufacturer of pumps and compressors and has continued with the acquisitions of Vetco Gray, Hydril Pressure & Control, Wood Group’s support division, Wellstream, Lufkin Industries and Cameron International’s Reciprocal Compression business, as well as Dresser Industries, a spinoff from Dresser-Rand.

[3] GE?s Investor Meeting for the Oil & Gas segment webcast shows an assumption (made in September, 2014) of a base case price of Brent Crude at around $100 / bbl and a demand growth of roughly 1.5% per year. Under these assumptions, GE is forecasting total industry spend to increase by about 6% per year CAGR through 2017.