Joe Cornell, CFA, from Spinoff Advisors, sent through an interesting paired investment idea that seems very interesting: Yahoo!?s spinoff of its stake in Alibaba.

Spinoffs are difficult for most investors to analyze and institutional investments in post-spinoff entities are at least partially driven by structural biases (e.g., large funds not being able to hold smaller, post-split entities). As such, spinoffs have historically offered?and continue to offer?potentially lucrative inefficiencies for intelligent investors.

In the case of Yahoo, it looks like the market is adding 1 + 1 + 1 and saying the answer is 2 rather than 3.

This article gives the rationale for the investment, lays out how the strategy might look from an option perspective, and discusses how spinoffs are handled in the option market, as well as providing an appendix focusing in on Yahoo!?s capacity to generate cash.

I have never invested in this type of event-driven strategy before, so am going to allocate a bit of capital to it and get a better perspective of the practical issues involved.

(You can also read this document and attached Appendices in PDF form)

EXECUTIVE SUMMARY

- Yahoo! YHOO is spinning off its stake in Chinese Internet retailer Alibaba BABA in a transaction scheduled to close in 4Q2015.

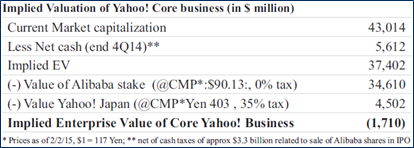

- Joe Cornell, CFA, of Spinoff Advisors points out that present market pricing suggests an exploitable inefficiency in this transaction. The implied value of Yahoo!?s core business is less than zero when adjusted for the market capitalization of Yahoo!?s stakes in Alibaba and Yahoo! Japan YAHOY.

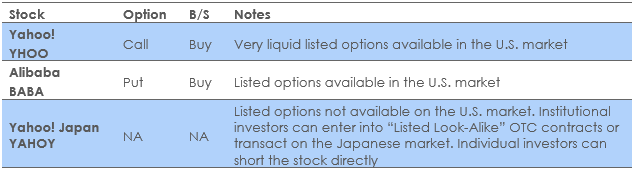

- Buying 47 Yahoo! call options for every 23 Alibaba put options purchased and 300 shares of Yahoo! Japan stock sold will isolate investment exposure in Yahoo!?s core business.

- This investment can be implemented using various combinations of long calls and long puts and the investment?s characteristics will depend upon strike prices chosen. Examples are given below (page 5 of PDF document).

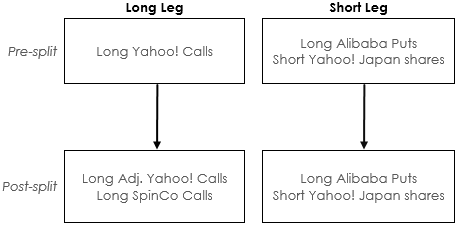

- In the case of spinoffs and other corporate actions, the option exchange resets strike prices on the original company?s options and grants options in the SpinCo to holders of the original options.

YAHOO!?S SPINOFF OF ALIBABA

Yahoo! wants to avoid paying capital gains taxes while liquidating its remaining 15% stake in Alibaba. It has announced that it would do so by a tax-free spinoff of a non-core operating unit that will be capitalized by Yahoo!?s remaining 384 million shares of Alibaba. Yahoo! has 988 million shares outstanding at the end of 4Q14, so every holder of Yahoo! shares will receive (384 / 988 =) 0.3887 shares of ?SpinCo?, a new business whose main asset will be shares of the Chinese Internet retailer.

Yahoo?s value is a function of its stake in Alibaba, the value of its own core business, and the value of its stake in Yahoo! Japan (in which Yahoo! owns a 36% stake).

According to Cornell?s Spinoff Research note on the transaction, present valuations indicate the market is treating Yahoo!?s U.S. business as being worth less than nothing.

Figure 1: Source: Spinoff Research report on YHOO (2/3/2015)

Yahoo! is planning to retain its stake in Yahoo! Japan but to spin off its remaining stake in Alibaba in 4Q15, after its year-long lock-up period after Alibaba?s IPO ends.

INVESTMENT RATIONALE

Since the U.S. subsidiary is trading for an implied negative enterprise value, there is the opportunity for a low-risk long-short investment. This investment will take the form of isolating the U.S. subsidiary by buying shares in YHOO (which also give an investor a claim on Yahoo!?s net cash balance) while shorting an appropriate amount of BABA and Yahoo! Japan.

Long

Yahoo! Consolidated

Short

Alibaba and?Yahoo! Japan

Equals

Targeted investment in Yahoo! Core + Net Cash

The equity legs balance perfectly, so the strategy hinges upon the value of the net cash balance. As long as Yahoo! does not destroy $1.7 billion in the value of its core business by the time Alibaba is spun off, the post-spinoff price for Yahoo!?s core business should increase. Even a bankrupt business is worth nothing, after all.

How much more valuable depends on how durable the present net cash balance is and whether it has the potential to grow in the future. To get a sense of how much cash Yahoo! is generating, please see Appendix I: Valuation Considerations in?the PDF.

OPTION INVESTMENT STRUCTURE

An investor can replicate the hedged structure laid out in the Investment Rationale section above using calls and puts, respectively, to replace long and short stock investments.

These shorts would be balanced by an investment in Yahoo! call options with a notional value equal to that of the short side of the investment. With a notional value of $4,200 for one contract of Yahoo!?s ATM call options, we would balance the above bearish investment with the purchase of 47 of Yahoo!?s call option contracts.Using the Spinoff Advisor?s calculations from figure 1, the ratio of the value of Yahoo!?s stake in Alibaba ($34,610) versus that of Yahoo! Japan ($4,502) is roughly 7.7:1 or 23.0:3. As such, a hybrid option-stock strategy would buy 23 contracts of Alibaba puts and sell 300 shares of Yahoo! Japan stock. The notional value of one At-the-Money (ATM) Alibaba contract is $8,500; the value of 100 shares of Yahoo! Japan stock is $717. Transacting in a 23:3 ratio implies a minimum notional value of the ?short? side of the trade of ($195,500 worth of BABA options + $2,151 worth of YAHOY stock =) $197,651.

Expiration

Because the spinoff transaction is scheduled to take place in 4Q14, we should select Yahoo! and Alibaba options expiring after that. There are two LEAPS available for both stocks: January 15, 2016 and January 20, 2017.

The number of expirations will increase as time passes (i.e., there will be intermediary expirations between the two listed above), so waiting until later in the year to enter into this structure will decrease the risk of the transaction occurring after the option expiration.

On the other hand, if the market moves to correct this mispricing before the transaction closes, not entering into the transaction at present would mean one misses the investment opportunity.

To balance these risks, one can enter into the structure over time?making one-third or one-half of the desired allocation now with the expirations presently available, and the remainder later in the year when more expiration choices exist.

Strike Prices

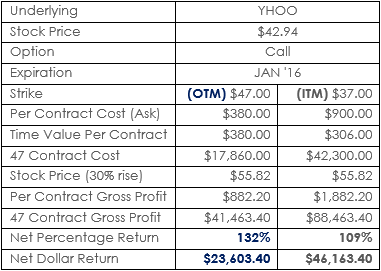

The amount of leverage in an option investment varies by the strike price of the option selected. In-the-Money (ITM) options have a lower leverage than ATM options, which in turn have lower leverage than Out-of-the-Money options.

Higher leverage means a lower up-front cost and higher percentage returns. Lower leverage means a higher up-front cost and higher dollar returns. We can see this clearly in the example below:

Note also the difference between Time Value per Contract between the two options. Time value represents a sunk, unrecoverable cost, and should be considered a realized loss as soon as it is paid. Obviously, realizing losses is not a path to investment success, so intelligent investors should always minimize the amount of money spent on time value.

Time value as a proportion of contract cost becomes progressively lower the deeper the strike is ITM and is 100% for any ATM or OTM options. Since ATM options are the most expensive ones and since all of that expense is time value, we advise to avoid buying them.

Example Structures

With these principles in mind, we look at several scenarios using strategies of different moneyness for the call and put sides.

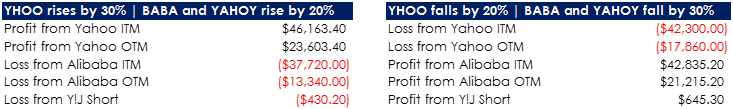

For example, in the case where Yahoo! rises by 30% (left-hand table), net profit from 47 purchased ITM call options (struck at $37) would amount to $46,163.40. However, if Yahoo! were instead to fall by 20% (right-hand table), the position would lose $42,300.00.

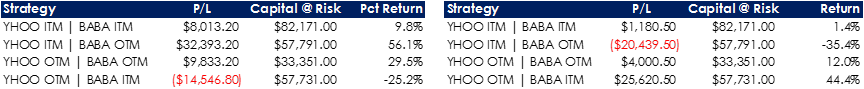

We can then look at various combinations of moneyness for each leg to see what profit and loss would be generated for different structures (in all of the structures below, P/L from the Yahoo! Japan short is included). In the tables below, ?Capital at Risk? equals the amount of money spent on option premium for both long and short legs of the investment, plus the notional value of the short position in Yahoo! Japan.

| YHOO rises by 30% | BABA &?YAHOY rise by 20% | YHOO falls by 20% | BABA &?YAHOY fall by 30% |

Combining an ITM on one leg with an OTM on the other leaves one exposed to a directional bet. If the stocks move in the direction beneficial to the ITM leg, the overall structure is very profitable, but if the market moves against the ITM position, the losses are the most severe.

The combination of OTM legs on both the long and the short sides generates the best looking overall risk / return profile, but buying OTM options mean paying a proportionally larger up-front sunk cost and the position will perform worse if the underlying stocks do not move very much.

Note that all these scenarios calculate on the basis of pre-split stock-price movements. For post-split effects, see the following section.

OPTION ADJUSTMENTS

When a spinoff occurs, the option exchange does two things: adjusts the strike price of the stub (Yahoo!?s core business in this case) and grants options in the new SpinCo to holders of the pre-spin options. These adjustments are engineered in such a way to allow the option holder?s economics to remain the same pre- and post-split. In other words, if your option contract in a pre-spin company are worth $1,000 / share, your options in the post-split entities will aggregate to the same $1,000.

Once the shares split, the investor can liquidate the SpinCo options to retain the original investment or can continue to hold the SpinCo options.