A?friend of mine, Brent,?who has a lot of experience investing in oil companies and projects–sent through an idea for an option investment in a company called Whiting Petroleum (WLL). He?has structured what looks like a very attractive investment in the company, knowing full well that the price of oil is volatile in the short term, but that longer term, the supply / demand?balance is likely to drive the price higher.

How much of an effect will debt levels of small oil companies have on production levels? What role does geopolitics likely play in this saga? What are some best- and worst-case ranges for oil prices over the next six months, year, and two years? These are all topics of the following exchange.

Comments from Brent

There are a few things that would prompt oil supply to fall off in the next 9-12 months, including…

- Shale oil well completions are wrapped up for previously committed or drilled wells (in 6-9 months)

- Capital budgets are restrained (happening now)

- Internationally high-cost projects are delayed (happening now)

- Drilling stops in marginal shale fields with high production costs (happening now)

- Natural gas and natural gas liquids decline in price reducing the income from oil/gas mix shale (this is already happening expected to accelerate in 2015/2016)

- Shale well decline is consistent with historical trends (typical shale wells decline 50%-60% after 12 months)

- Offshore drilling is curtailed due to high cost (they need >$100)

- Tar sands output is allowed to decline (they need >$60)

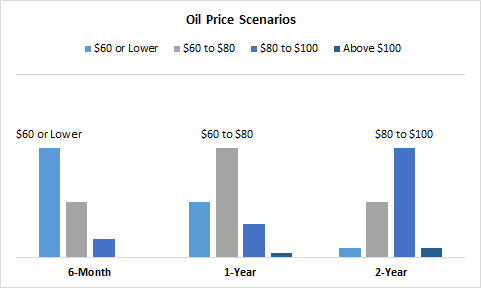

Looking at these supply-side effects and how they will likely impact oil price, I get something like the following graph.

What do you think about these price scenarios and time frames?

Erik’s Response

You know this?field much better than I do, but from what I have read,?believe your characterization of what’s happening on the supply side is right on target. The three things I wonder about from an oil price perspective that might make the ranges lower for longer are…

- The possible influence of leverage on E&P companies,

- Demand side considerations, and

- Saudi collusion for the overthrow of Putin.

For the first, I just tweeted out a WSJ story about the indebtedness of E&Ps [N.B. Exploration and Production companies] that was pretty sobering. Of course these companies?have been leveraging themselves up to the hilt for the past few years and now have balance sheets that feature a gorilla’s worth of debt stomping on a cockroach’s worth of equity. There will be some point at which the cockroaches will all get squished, but in the interim, the high debt levels incentivize producers to keep pumping (under the theory that at least they can pay their coupons and the salaries of a few roughnecks if not much else). If this is true–and I don’t know to what extent it is or how long it can last–the supply side glut may last a little longer perhaps.

For the second, Europe seems like it is?really struggling right now and, while it is hard to know what reports to trust and which not to, China seems like a bug in search of a windshield. Even if supply is falling off fairly quickly, if demand is falling even quicker still, that could put a longer-term damper on the price of WTI and Brent.

For the third, when oil started falling and the Saudis said they were going to keep production up, I thought the oil price decline was more about geopolitics than anything else. Everyone else was talking about fracking, but I was thinking about Emperor Putin. The U.S. wants to see Putin Qadafied (a new verb I just made up that means “to treat the former leader of a nation-state?the way Qadafi was treated after the Libyan crisis”)?and the best way to do that is to make sure that oil price remain low for a long time… This might just be my naturally cynical self, but if it is true, the Saudis may be willing to keep the price down long enough for Putin’s government to fall.

Of course, Saudi potentates?can’t be happy about the lower prices (it means that they have to put off razing a?60,000?square foot mansion to build another in its place for a few years), but it serves their needs as well vis-a-vis bringing pain to their arch-enemy apostates in Iran (indeed, the fact that the U.S. and Iran are starting to make more friendly sounds toward one another can’t make the Saudis very happy, so the low oil prices is a way of attacking their own enemies while helping the U.S. attack theirs).

These are things that I can think of that would cause oil prices to be lower for longer, even given the natural, supply-side constraints you’re talking about. Your structure for the WLL investment makes a lot of sense, for the reasons we discussed, but I can’t help thinking that oil prices can remain low for a bit longer.